With the rise of healthcare consumerism, patients are looking for greater transparency and convenience, especially with healthcare payments. New innovations in healthcare technology promote interoperability, enabling patients to share data with providers. This not only helps reduce costs, it also offers convenience when providers improve patient collections. In many cases though, healthcare providers have not yet taken advantage of the available technology.

Despite the many benefits of digital solutions, some medical groups still utilize manual and paper processes. These workflows are often more error-prone, less efficient, and less effective in collecting payment from patients.

The statistics surrounding the healthcare revenue cycle are bleak. According to a 2023 report published by InstaMed, 75 percent of healthcare providers report that it takes more than one month to collect any patient payment. The same report found that 71 percent of medical groups still rely primarily on outdated manual processes to collect payments. At the same time, 85 percent of consumers are interested in paying medical bills online.

According to the Healthcare Payments Insight Report, 79 percent of patients worldwide use contactless methods. Nearly half of those who don’t use contactless methods would like their healthcare provider to offer them. More than 50 percent of patients report that the COVID-19 pandemic impacted how they pay their providers.

Making Progress to Improve Patient Collections

Medical groups must make an important change addressing high patient demand for digital payment methods and faster collections for provider revenue cycles. In this age of consumerism, it’s imperative that providers use methods that meet patient preferences. It is also of utmost importance for them to follow best practices geared toward increasing collections.

5 Best Practices to Follow

1. Promote Price Transparency

Patients want to know approximately how much they’re responsible for paying upfront and what’s covered by their insurance. According to our 2023 Care Access Benchmark Report, 77 percent of patients say out-of-pocket costs are extremely or very important when choosing a new provider. Although legislation was passed requiring health payers to allow patients to access providers’ prices for multiple services and procedures, that data can be hard to understand. Many patients don’t know how much they owe until they receive a bill and therefore are slower in paying.

Let your patients know that full or partial payment is due at the time of service. Even if you aren’t able to give them an exact amount for their financial responsibility for care, providing them with an estimate typically increases patient satisfaction. The result is fewer accounts sent to a collection agency, increased time of service (TOS) collections, and increased overall patient collections.

2. Provide Multiple Options for Patients to Pay

As mentioned earlier, 85 percent of patients want to make payments online. That represents a sizable opportunity for providers to cater to customer preferences and improve patient satisfaction. In fact, giving patients more than one way to pay their medical bill by utilizing an omnichannel approach increases the likelihood they’ll follow through with payment. Providing a combination of payment modalities, including online, mobile, in-person, via email, and over-the-phone can therefore improve patient collections.

Digital forms of payment, including those with card-on-file capabilities, are becoming more popular, especially among Millennials and Gen-Z, as are HIPAA-compliant patient portals.

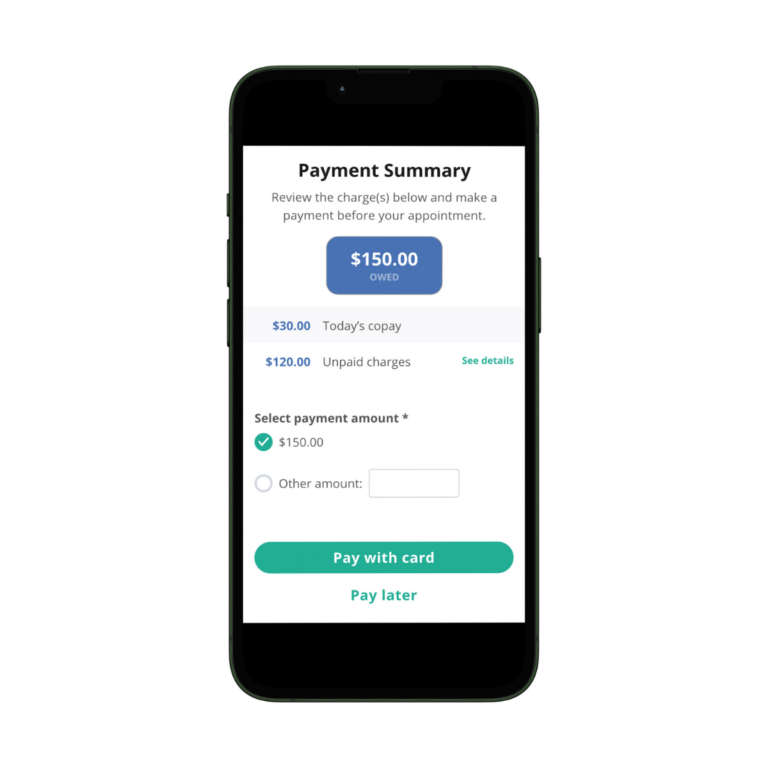

Advanced digital patient intake systems like Kyruus Health Check-In offer pre-visit and digital payment methods that can help increase patient collections.

3. Offer Payment Plans

Receiving a big medical bill can be scary for a lot of patients. If they think they have to pay the entire bill at once, they may decide not to pay it at all.

When you promote payment plans, you enable patients to pay off medical debt a little at a time instead of all at once. You can also offer a discounted amount for any patient who enrolls in your payment program or those who are uninsured. The advantage for your medical group? It allows you to help streamline your collection process while procuring more patient payments.

4. Use Time of Service Payment Collections

According to research, physician practices only collect 50-70 percent of payments once patients leave the office. Collecting amounts due from patients at the time of service allows you to boost your revenue cycle by reducing accounts receivable and back-end collection costs. TOS collections increase cash flow, and decrease the administrative burdens of tracking and writing off bad patient debt. Make sure that the patient contact and insurance information you collect is accurate and up-to-date.

5. Routinely Train Your Staff

Your front office staff set the tone for the entire patient journey. It’s important to make sure they are trained to operate at a high productivity level. Educating your staff about the importance of upfront collections makes it easier for them to discuss the issue with patients. Train them on specific collections procedures — like how to create cost estimates and read eligibility screens — and how to ask patients for payment without offending them. Your team members should be able to explain things such as deductible, copayment, coinsurance, and out-of-pocket maximums. When they don’t have the answers (i.e., health plan issues), your team should be able to provide resources. Additionally, this communication should take place at time of check-in, during the healthcare process, and at the end of service. This cadence increases TOS collections and in turn, increases overall patient collections.

Patient Satisfaction Drives Loyalty and Ultimately, Improve Patient Collections

If you don’t think payment is an important part of your interaction with patients, you might not be aware that many individuals who aren’t offered a favorable payment experience are likely to switch to a different provider. At Kyruus Health, our payment feature provides patients with a positive experience by enabling them to review their co-pays and outstanding balances during check-in, pay at the time of service with any major credit or debit card or qualified HSA/FSA card, and set up a card on file for annual payment contracts, to cover co-insurance obligations, or to make payments.